Crypto and clemency converge in Trump’s pardon of Binance founder

Zhao’s pardon underscores a shift: in Washington, crypto’s legal fortunes now rise and fall less on compliance records and more on political alignment.

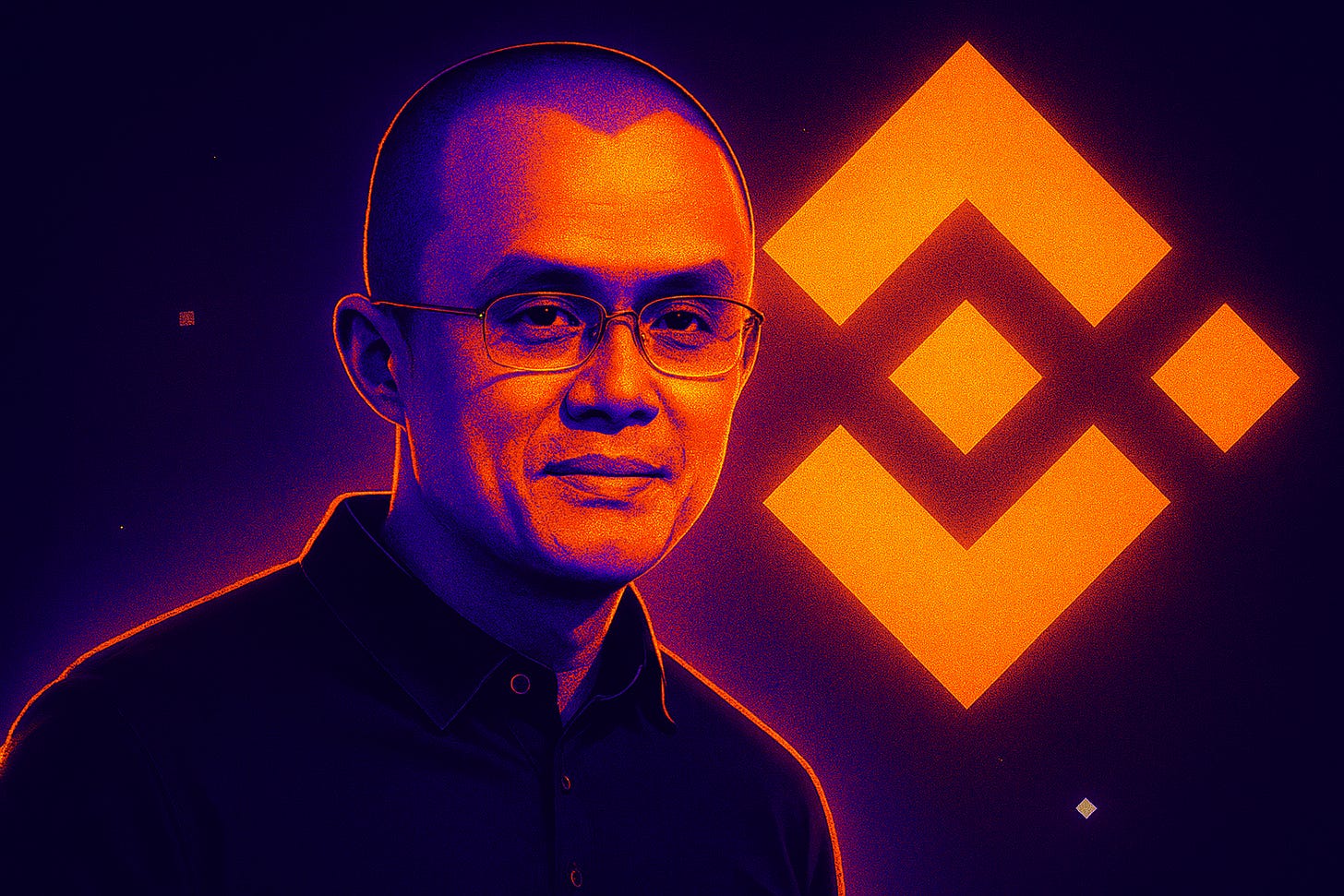

President Donald Trump granted a full pardon in late October to Changpeng Zhao, the billionaire founder of crypto exchange Binance Holdings Ltd. Zhao had pleaded guilty in 2023 to violating U.S. anti-money-laundering laws. His pardon follows months of lobbying from crypto industry allies amid growing ties between Binance and a Trump-family-linked digital asset venture.

The White House described the pardon as part of the president’s “commitment to fair treatment of innovators,” though Trump later told CBS’s 60 Minutes he “didn’t know who” Zhao was.

The Law in Play

Zhao admitted to violating the Bank Secrecy Act, which requires financial institutions to maintain effective anti-money-laundering programs. Federal prosecutors said Binance’s weak controls allowed criminals, sanctioned entities, and terrorist groups to move billions through the platform.

Supporters of the pardon argue that Zhao had cooperated with authorities, accepted responsibility, and completed his four-month p…